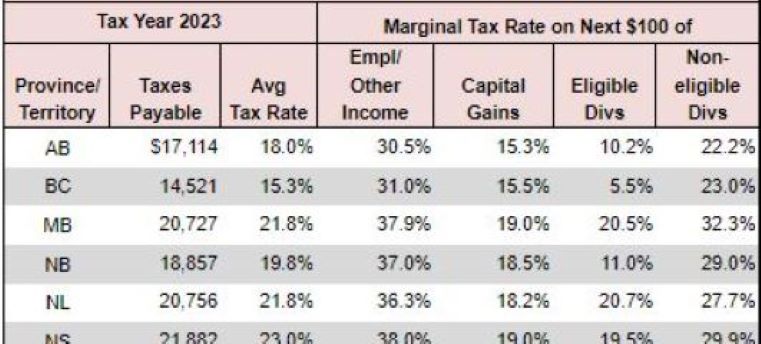

2022 tax rates, brackets, credits | combined federal/provincial tax brackets | Manulife Investment Management

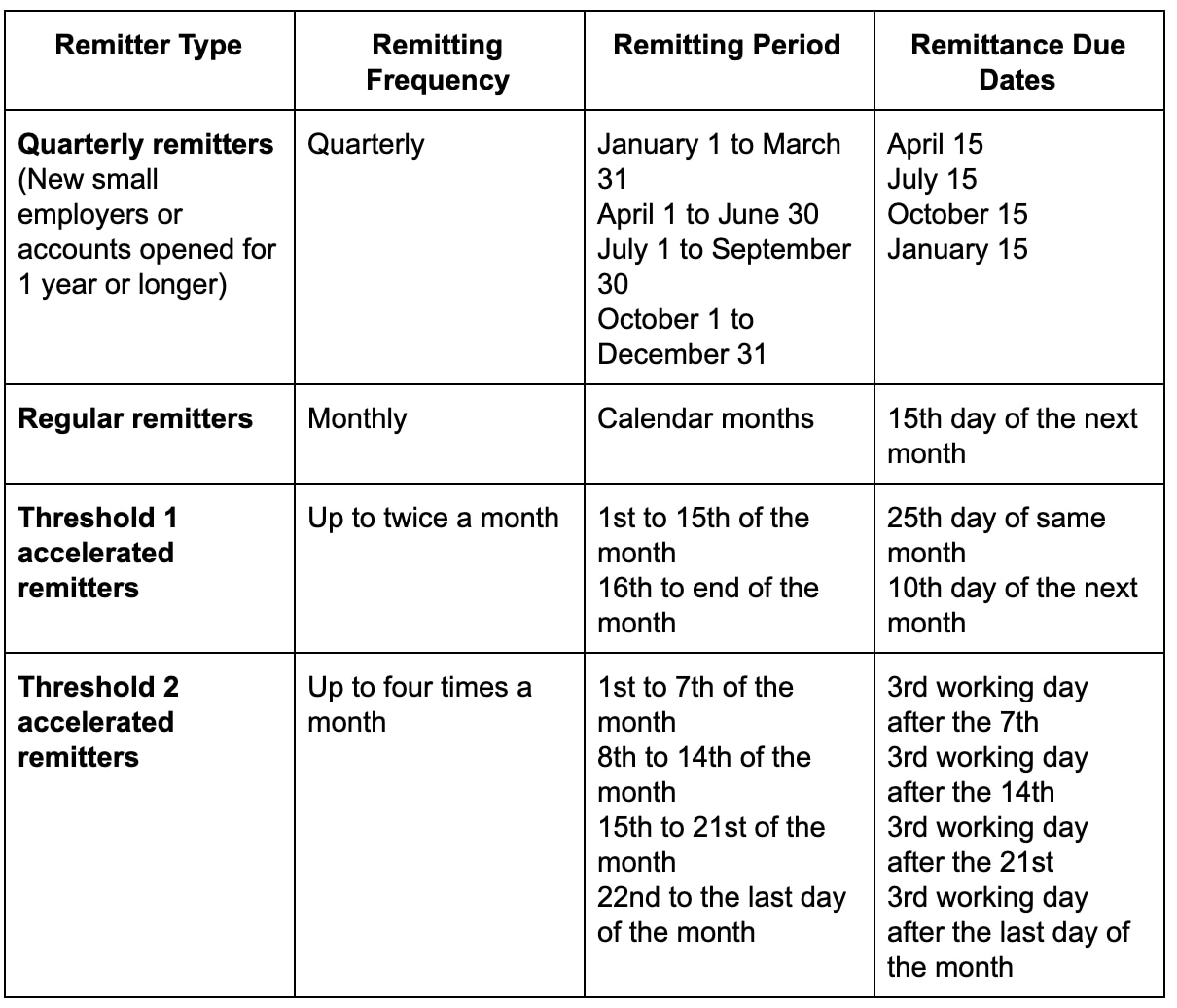

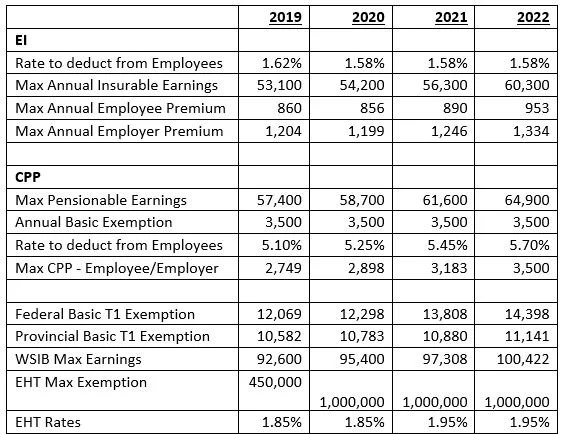

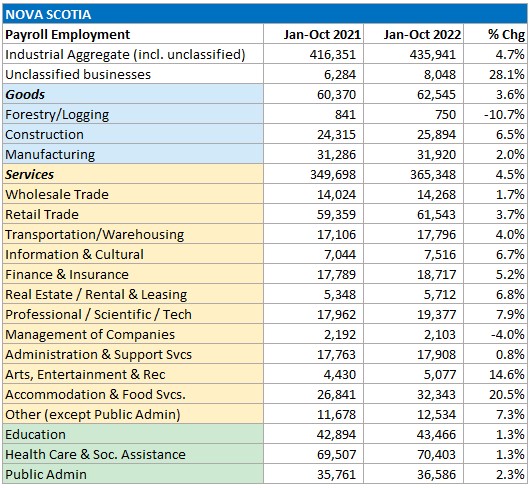

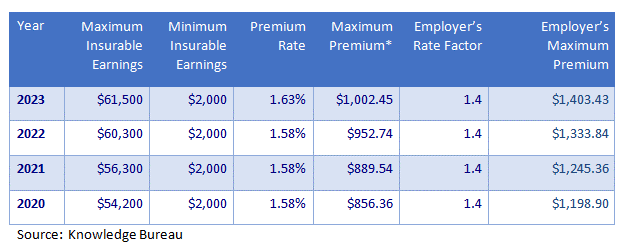

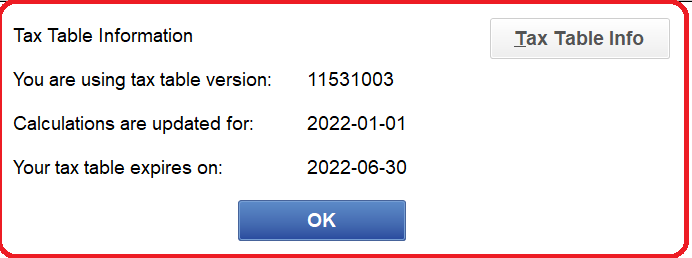

Payroll Tax tables are available - Effective from January 1, 2022 to June 30, 2022. - FinTech College of Business And Technology

Payroll Tax tables are available - Effective from January 1, 2022 to June 30, 2022. - FinTech College of Business And Technology

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)